"boredalways" (boredalway666)

"boredalways" (boredalway666)

04/30/2020 at 21:30 ē Filed to: Annoying adverts, Fortune cookies, Ruined fake traditions

1

1

8

8

"boredalways" (boredalway666)

"boredalways" (boredalway666)

04/30/2020 at 21:30 ē Filed to: Annoying adverts, Fortune cookies, Ruined fake traditions |  1 1

|  8 8 |

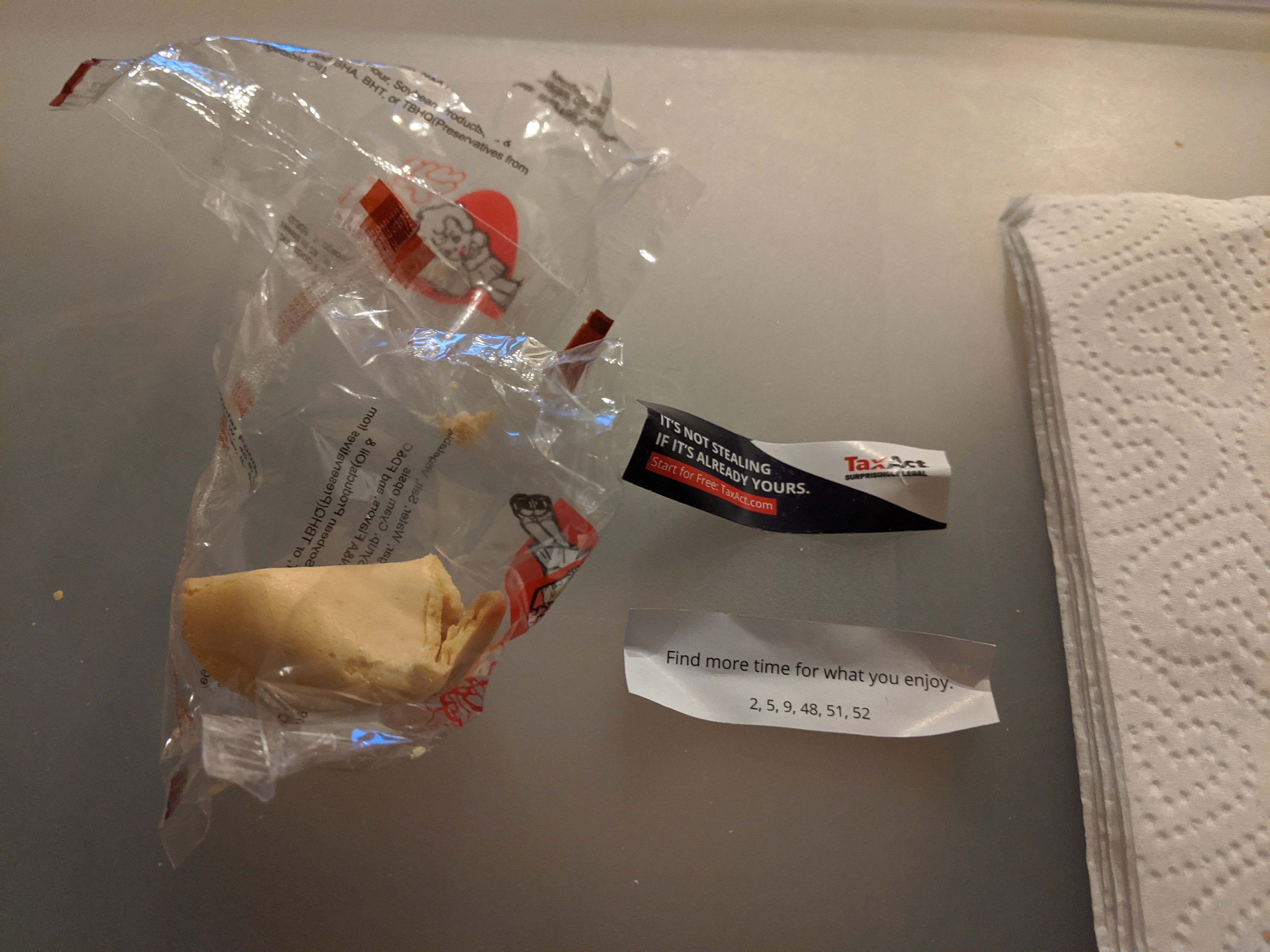

Canít even trust fortune cookies these days... itís like excessive, pop-up adverts by herbs.

smdh

facw

> boredalways

facw

> boredalways

04/30/2020 at 21:31 |

|

Tax prep companies are some of the scummiest out there. Remind me again why the IRS canít just send us a bill based on the information they already have reported to them?

WilliamsSW

> boredalways

WilliamsSW

> boredalways

04/30/2020 at 21:32 |

|

I enjoy not being bombarded by ads thanks

Full of the sound of the Gran Fury, signifying nothing.

> boredalways

Full of the sound of the Gran Fury, signifying nothing.

> boredalways

04/30/2020 at 21:35 |

|

Advertising in fortune cookies? Thatís as American as, well, fortune cookies... But yeah, thatís slimy.

ClassicDatsunDebate

> boredalways

ClassicDatsunDebate

> boredalways

04/30/2020 at 21:37 |

|

...in bed.

For Sweden

> facw

For Sweden

> facw

04/30/2020 at 21:40 |

|

Because we havenít banned freelancers yet.

Soon, God Willing.

Stef Schrader

> For Sweden

Stef Schrader

> For Sweden

04/30/2020 at 21:56 |

|

P

ay me what Iím worth and offer me decent

benefits,

you cowards!!!

facw

> For Sweden

facw

> For Sweden

04/30/2020 at 22:41 |

|

Well they can do it the old way, and everyone else can do it the easy way. Or we can require the people who hire them to report that income, and they can do it this way too. Iím sure youíd miss some cash income, but thatís likely to be small time anyway.

Svend

> facw

Svend

> facw

05/01/2020 at 01:21 |

|

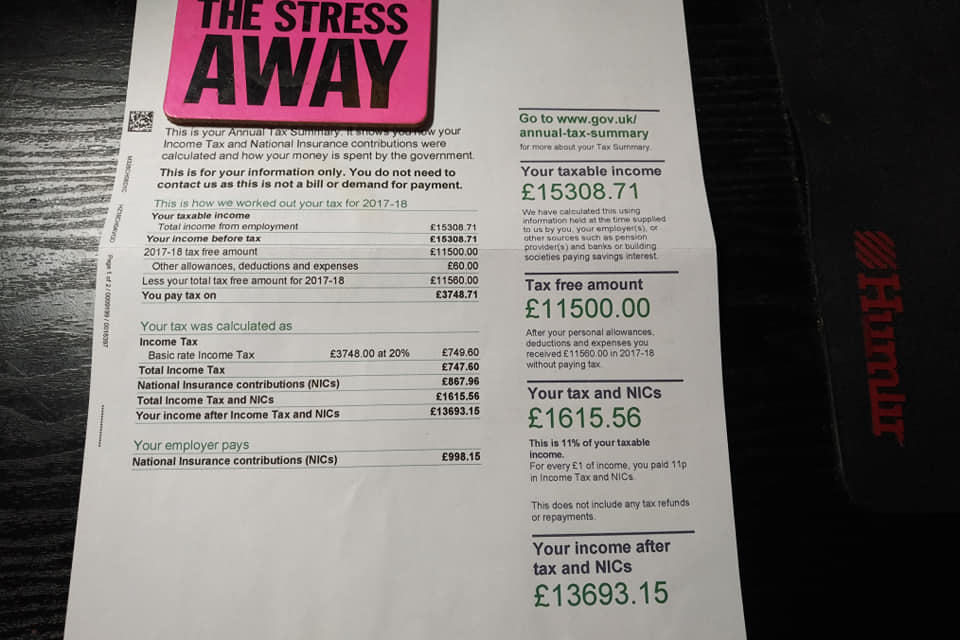

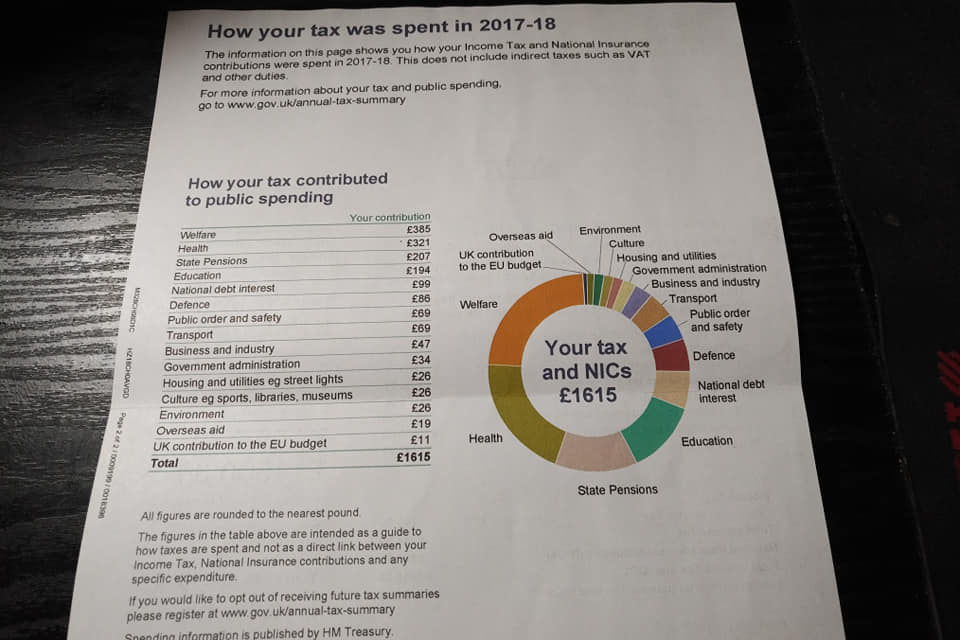

hankfully we only file tax returns if we are self employed.

The rest of us have our taxes deducted at source from each paycheck.

Itís simply broke down into total pay, taxable pay, tax deducted and actual pay.

At the end of the tax year we get a full breakdown of where the taxes went and used for.

I can contest it if I think Iíve paid too much and either take a rebate or pay less tax the following year to balance it out.